Comprehensive Client Onboarding Framework

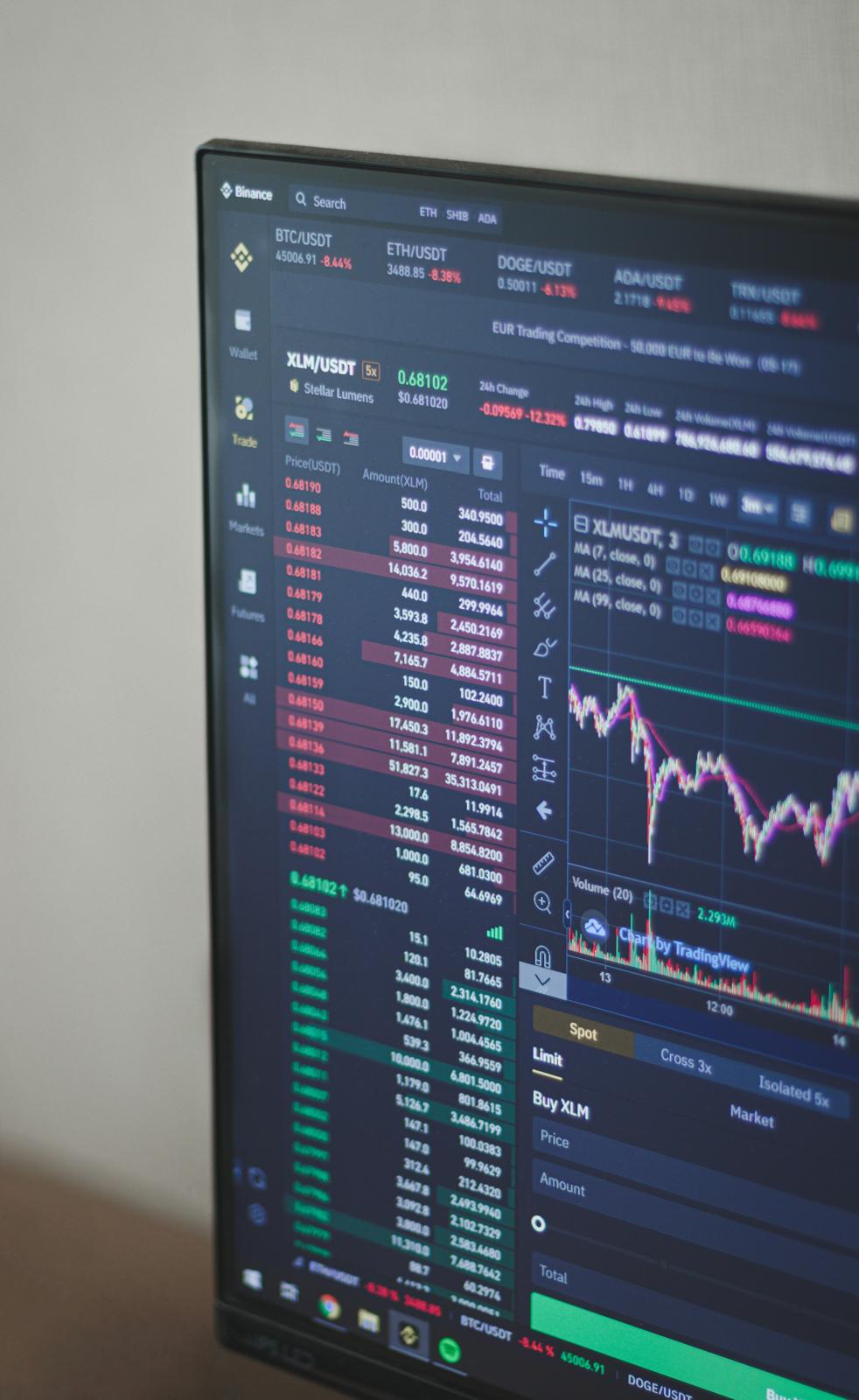

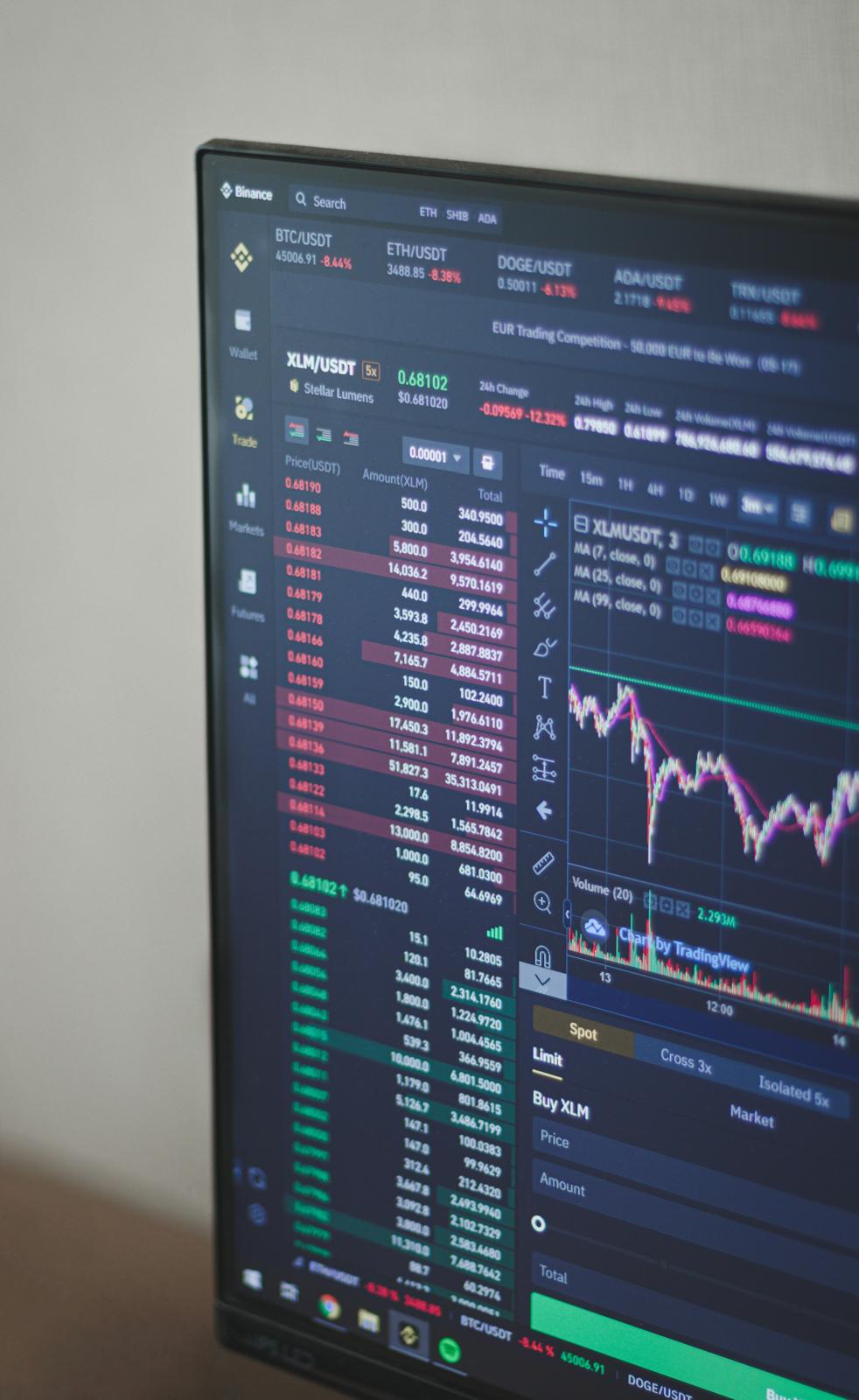

Simplified Financial Frontier ("the Company") is a premier financial services provider specialising in the execution and management of client investments across a global portfolio of asset classes, including equities (stocks), market indices, foreign exchange (currencies), and physical and derivative commodities.

In accordance with the highest international standards of financial integrity, regulatory compliance, and risk management, the Company maintains a rigorous and mandatory Client Onboarding and Know Your Customer (KYC) programme. This programme is a foundational component of our operational due diligence and a non-negotiable condition for establishing any client relationship.

The Company's KYC policy is established under the strict requirements of the Anti-Money Laundering (AML), Counter-Terrorist Financing (CFT), and Proliferation Financing regulations of the jurisdiction in which it is licensed and operates. This framework is designed to ensure full compliance with international directives and recommendations, including those promulgated by the Financial Action Task Force (FATF).

The policy serves to identify, assess, monitor, and mitigate risks associated with money laundering, terrorist financing, fraud, sanctions evasion, and other forms of financial crime. Simplified Financial Frontier is committed to upholding the integrity of the global financial system and protecting its clients and operations from illicit activities.

The primary objectives of the KYC programme are:

Prospective clients must provide the following documentation and information to initiate the onboarding process:

Enhanced Due Diligence measures are mandatorily applied to clients classified as presenting a higher risk. This classification may arise from, but is not limited to, the following factors:

EDD involves obtaining additional independent information to corroborate the client's source of wealth and funds, securing senior management approval for the relationship, and conducting more intensive ongoing transaction monitoring.

Given the Company's specialisation in dynamic and sometimes volatile markets (stocks, indices, currencies, commodities), clients are required to provide a detailed financial profile. This includes:

This information is critical for ensuring that the requested trading activities in leveraged instruments, foreign exchange, or commodity futures are appropriate and understood by the client.

KYC is not a one-time exercise. Simplified Financial Frontier employs automated surveillance systems and manual reviews to continuously monitor client transactions for patterns inconsistent with the client's profile, such as unexplained large deposits, rapid turnover of funds without clear financial purpose, or transactions with sanctioned entities.

Clients are obligated to inform the Company promptly of any material change in their circumstances, including changes in beneficial ownership, residential address, or financial situation. The Company reserves the right to periodically request updated documentation to ensure all KYC records remain current and valid.

By engaging with the onboarding process, the client explicitly consents to the collection, processing, and secure retention of their personal data for the purposes of compliance with AML/CFT regulations, identity verification, and risk management.

Simplified Financial Frontier adheres to strict data protection principles, ensuring that all client information is handled confidentially and securely, in line with applicable data privacy legislation. Information will only be disclosed to third parties where required by law or regulatory obligation.

Failure to provide complete, accurate, and satisfactory documentation or information as requested by Simplified Financial Frontier will result in the inability to establish a business relationship.

Furthermore, the Company reserves the absolute right, at its discretion and without liability, to refuse onboarding, suspend trading activity, or terminate an existing relationship if it is unable to satisfactorily complete its KYC or ongoing due diligence obligations. In such cases, accounts may be blocked, and transactions halted, with any remaining funds returned only to a verified account in the client's name, subject to all legal restrictions.

This document constitutes a formal summary of the Simplified Financial Frontier KYC policy. Specific requirements may be detailed further in the Client Agreement and associated onboarding documentation.