Market Intelligence & Execution: The Simplified Financial Frontier Approach

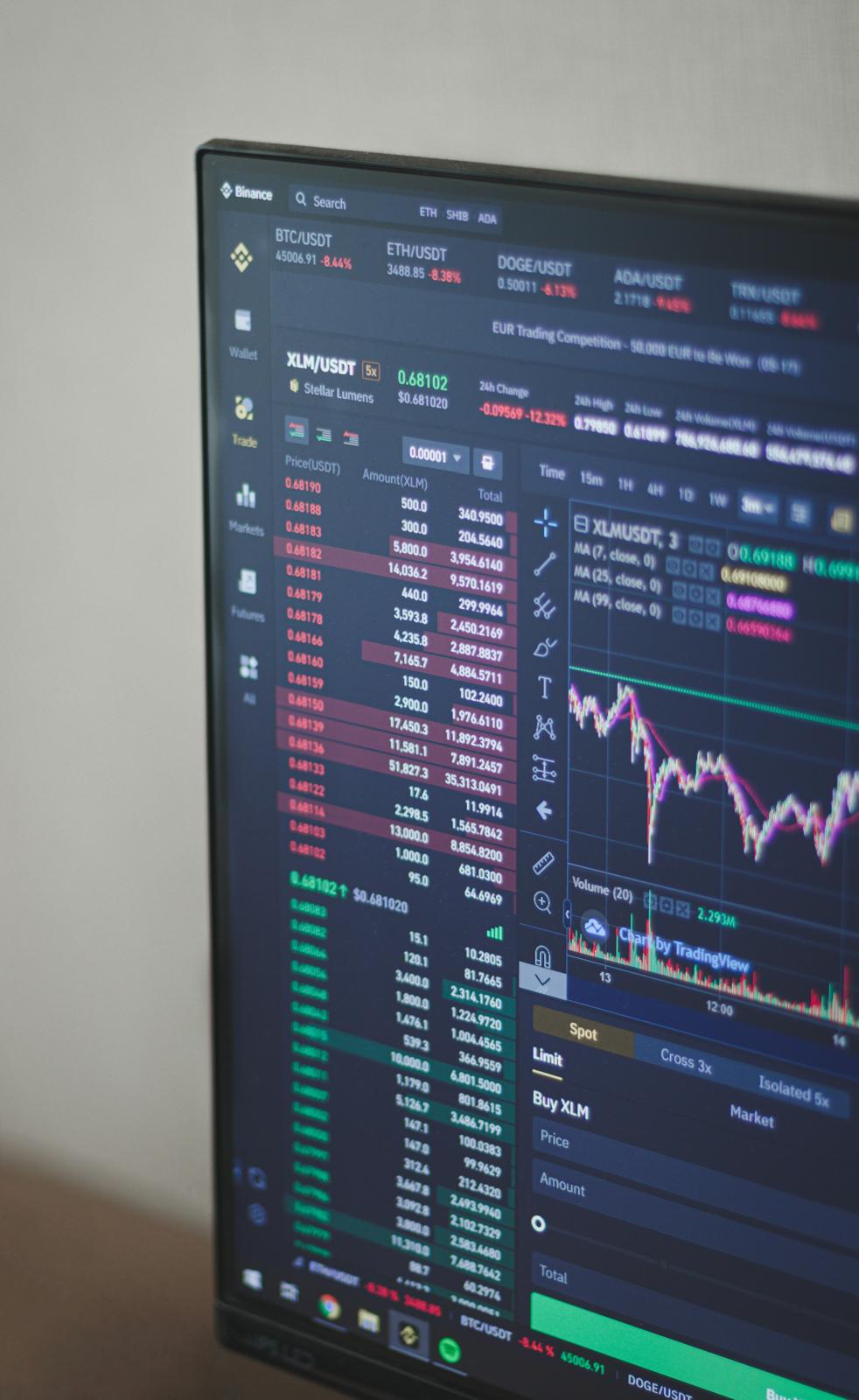

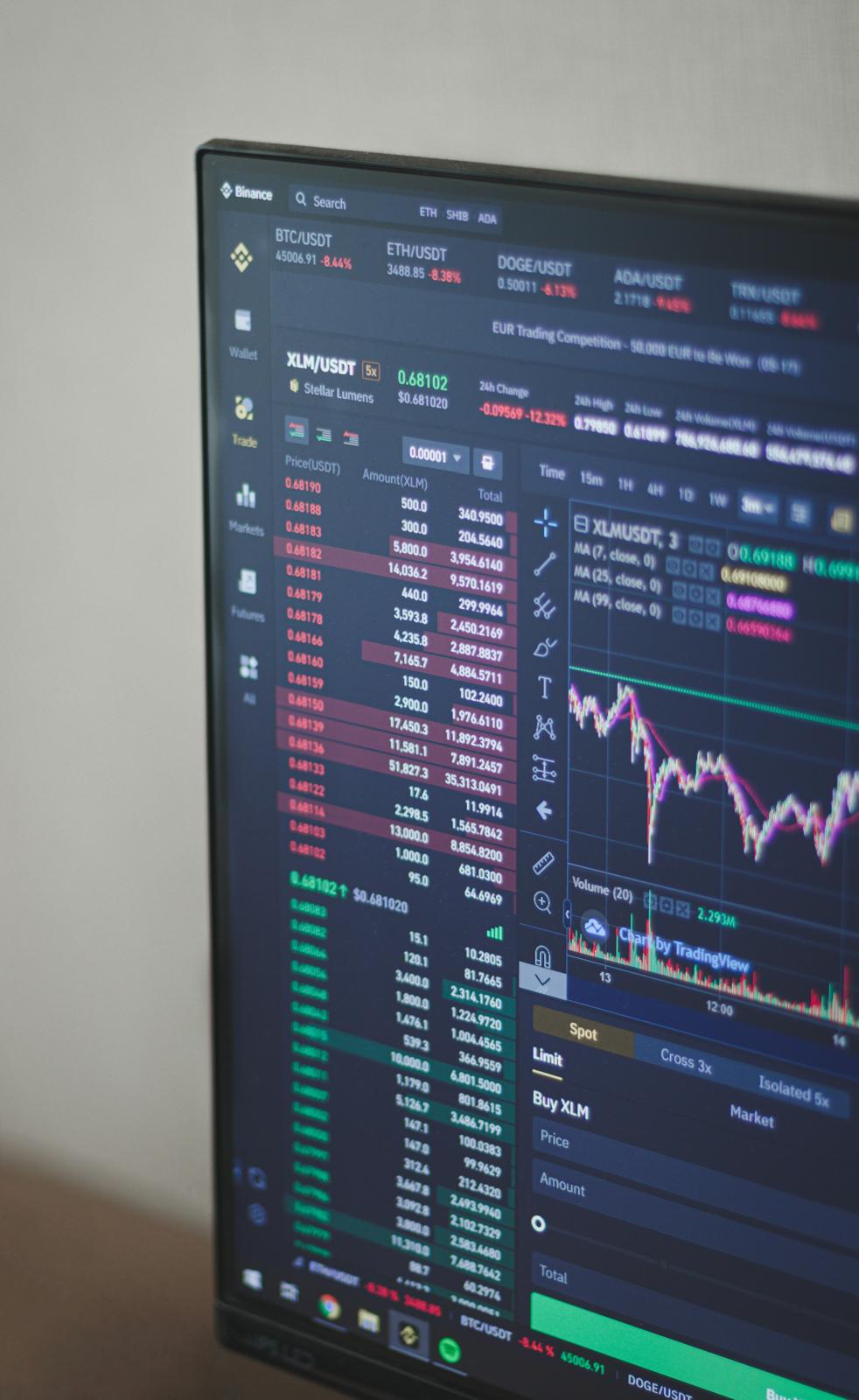

Real-time updates from global financial markets

At Simplified Financial Frontier, we believe that market news is not just information—it is the dynamic landscape upon which strategic investment decisions are made. Our daily process transforms real-time events into actionable insight, navigating the intersection of data, sentiment, and price action to pursue opportunities and manage risk for our clients.

We monitor a curated spectrum of catalysts across global markets:

Our trading philosophy is reactive to events but grounded in pre-defined strategy. We do not chase headlines; we interpret them through a rigorous framework.

News is immediately categorized by its expected impact, sectoral relevance, and longevity. A Federal Reserve policy shift is treated with a different protocol than a single-stock earnings surprise.

No news item is viewed in isolation. We contextualize it within existing market technicals, portfolio positioning, and our longer-term economic outlook. This prevents knee-jerk reactions.

For high-impact events, we pre-define probable market responses and corresponding action plans. Key support/resistance levels are identified, and position sizing is adjusted.

Trades are executed based on a confluence of news confirmation and price confirmation. We employ strict risk-management protocols, including tiered entry/exit points.

The market's reaction to news provides critical feedback. We analyze the efficacy of our responses, ensuring our frameworks adapt to evolving market structures.

While many firms react to news, we specialize in structured responsiveness. Our team combines decades of experience in fundamental analysis, quantitative modeling, and tactical execution. This synergy allows us to:

Visit our Market Insights and Weekly Brief for continuous analysis on how prevailing news is shaping our strategic outlook and portfolio positioning.

Partner with Simplified Financial Frontier for precision investing across global markets.

Get Started Today